TSP Millionaire Takeover: TPS 2026 Contribution Limits

TSP Millionaire Takeover: TPS 2026 Contribution Limits

By Aaron Oya

Membership in the Thrift Savings Plan “Million Dollar Club” is rising. Almost 19,000 TSP participants crossed the $1 million threshold between June and September 2025.

This surge in TSP millionaires is more than a statistical anomaly. It’s a trend! Two recently interviewed TSP millionaires expressed confidence this growth will continue and the data backs them up.

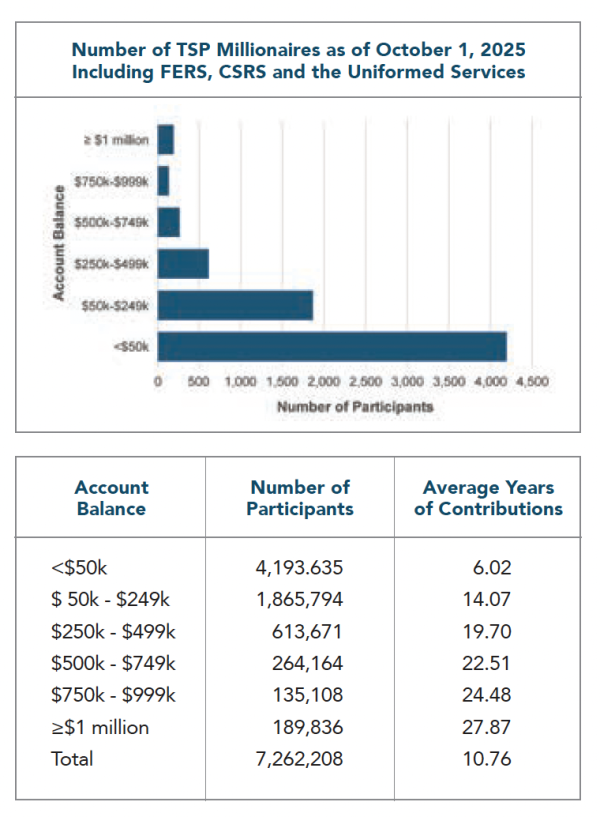

Quarterly Update: October 2025 Snapshot

Each quarter, the Federal Retirement Thrift Investment Board releases updated statistics on TSP account balances. As of Oct. 1, 2025, the distribution of participants by account balance was as follows:

Total participants: 7,262,208

TSP millionaires ($1 million or greater): 189,836

Average contribution years for millionaires: 27.87

This is a significant shift. Just five years ago, reaching $1 million in TSP savings typically required over 29 years of contributions. Today, that average is dropping due to:

- Strong market performance

- Higher salaries and matching contributions

- Increased IRS contribution limits

What You Can Control

While market conditions are beyond our control, two key levers remain in your hands:

- Maximizing pay with promotions and performance-based compensation

- Maximizing contributions

Higher pay directly boosts your 5% agency match, increasing your TSP contributions each pay period. But the real opportunity lies in understanding — and reaching — the IRS maximum elective deferral limit.

2026 Contribution Limits: Know Your Numbers

A simple, but revealing, question to ask your peers is “What is the maximum you can contribute to TSP in 2026?” Following are the IRS elective contribution limits for 2026. Go to tsp.gov for an explanation of the catch-up limits:

$24,500 — effective deferral limit

$8,000 — catch-up limit if you are 50 or older

$11,250 — catch-up limit for ages 60–63

These limits are powerful tools for accelerating retirement savings. Whether you are early in your career or nearing retirement, understanding and maximizing these thresholds can make a significant difference.

Final Thought

The path to becoming a TSP millionaire is clearer than ever. With strategic planning, disciplined contributions and awareness of IRS limits, the “Second Comma” is within reach for many postal employees. Let’s make 2026 the year of financial milestones!