Know the Requirements for RMDs

Know the Requirements for RMDs

By Joseph O’Donnell

Pittsburgh Branch 201 Legislative Chair

This column is to raise awareness of the IRS requirement regarding retirees taking required minimum distributions (RMDs) from their retirement accounts. I will identify the retirement accounts to which these rules apply and address the method to calculate the distributions. For more specific information on how these rules apply to your individual situation, contact your tax attorney and/or the IRS.

RMD requirements apply to the following retirement accounts:

- SEP IRAs

- Traditional IRAs

- SIMPLE IRAs

- 401(k) plans subject to RMDs only for 2022 and 2023

- 403(b)plans subject to RMDs

- Profit-sharing plans (can delay taking RMDs until retirement)

- TSP accounts

Contributions to Roth IRAs are after-tax contributions; RMD requirements do not apply.

A recent change in the law increased the age at which you must begin taking the required minimum distributions from 72 to 73. The applicable age is 73 if you reach 72 after Dec. 31, 2022. Failure to comply with RMD rules will subject you to steep penalties.

If you reached age 72 in 2022, you were required to receive your RMD by April 1, 2023. If you failed to do so, you are subject to a penalty. The penalty may be waived if you can show the failure was due to reasonable error and appropriate steps are being taken to remedy it. You are required to fill out Form 5329 and attach a letter of explanation. Instructions for Form 5329 can be consulted for furher explanation.

To avoid penalties, be sure to take the full amount of your RMD by the required dates and include it in your tax return.

RMD life expectancy tables are used to calculate required minimum distributions from qualified retirement accounts based on the average life expectancies of people in the United States. The IRS provides three lifetime expectancy charts to help retirement account holders figure mandatory distributions.

The Uniform Lifetime Table, the most commonly used, is for:

- All unmarried IRA owners calculating their own withdrawals

- Married owners whose spouses aren’t more than 10 years younger

- Married owners whose spouses aren’t the sole beneficiaries of their IRAs

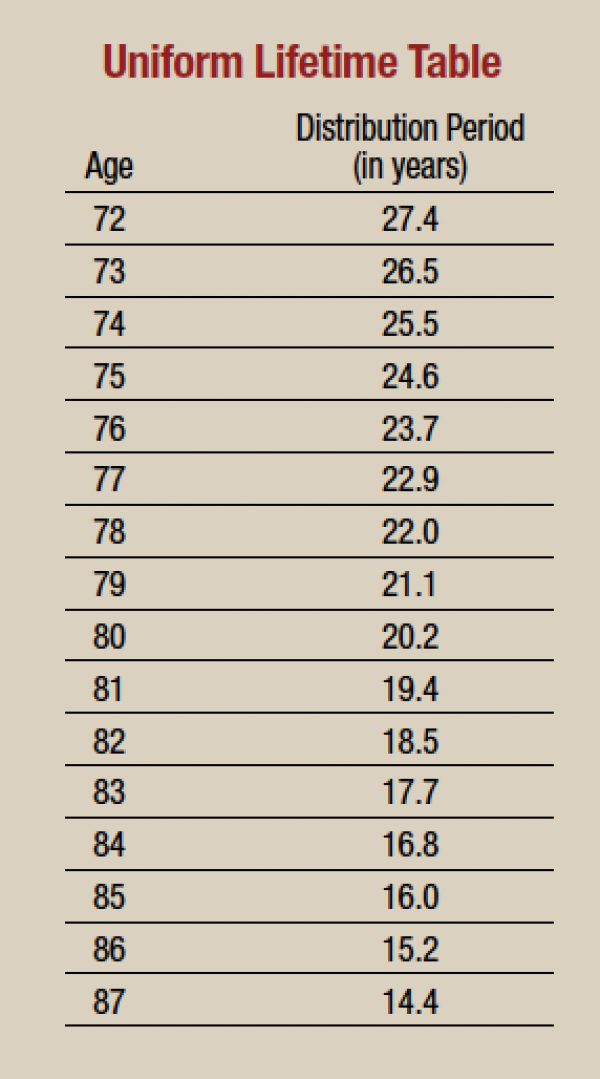

Following is a portion of the Uniform Lifetime Table; the table goes from age 72 to 120 and older.

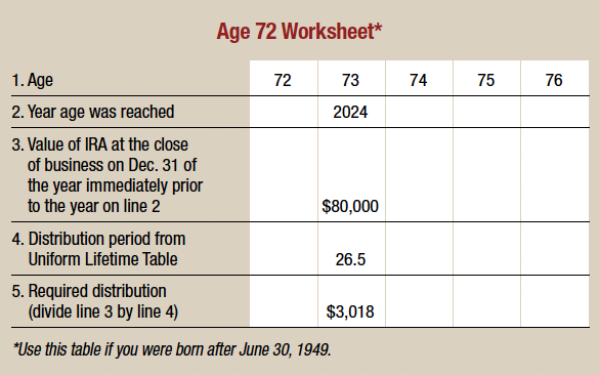

This worksheet helps calculate your RMD amount.

In this particular case, an annuitant would have to withdraw $3,018 to meet their RMD and include this income on their 2024 tax return. Note also the value of the IRA was determined at the close of business on Dec. 31, 2023.

The IRS has other tables for beneficiaries of retirement funds, account holders who have much younger spouses and inherited accounts when beneficiaries are not the spouse.

All tables and information on RMDs are available at IRS.gov, including Publication 590-B, “Distribution from Individual Retirement Arrangements (IRAs).” The publication is updated for each tax year. The agency also publishes an explanation of RMD rules called “Retirement Plan and IRA Required Minimum Distributions FAQs” that addresses the rules in easy-to-understand language. This publication is available on the internet or can be requested from the IRS. For any questions concerning RMDs, contact your financial advisor, your tax attorney or the IRS.